處理器與晶片組供應短缺,讓建構 Intel 平台的成本提升許多。

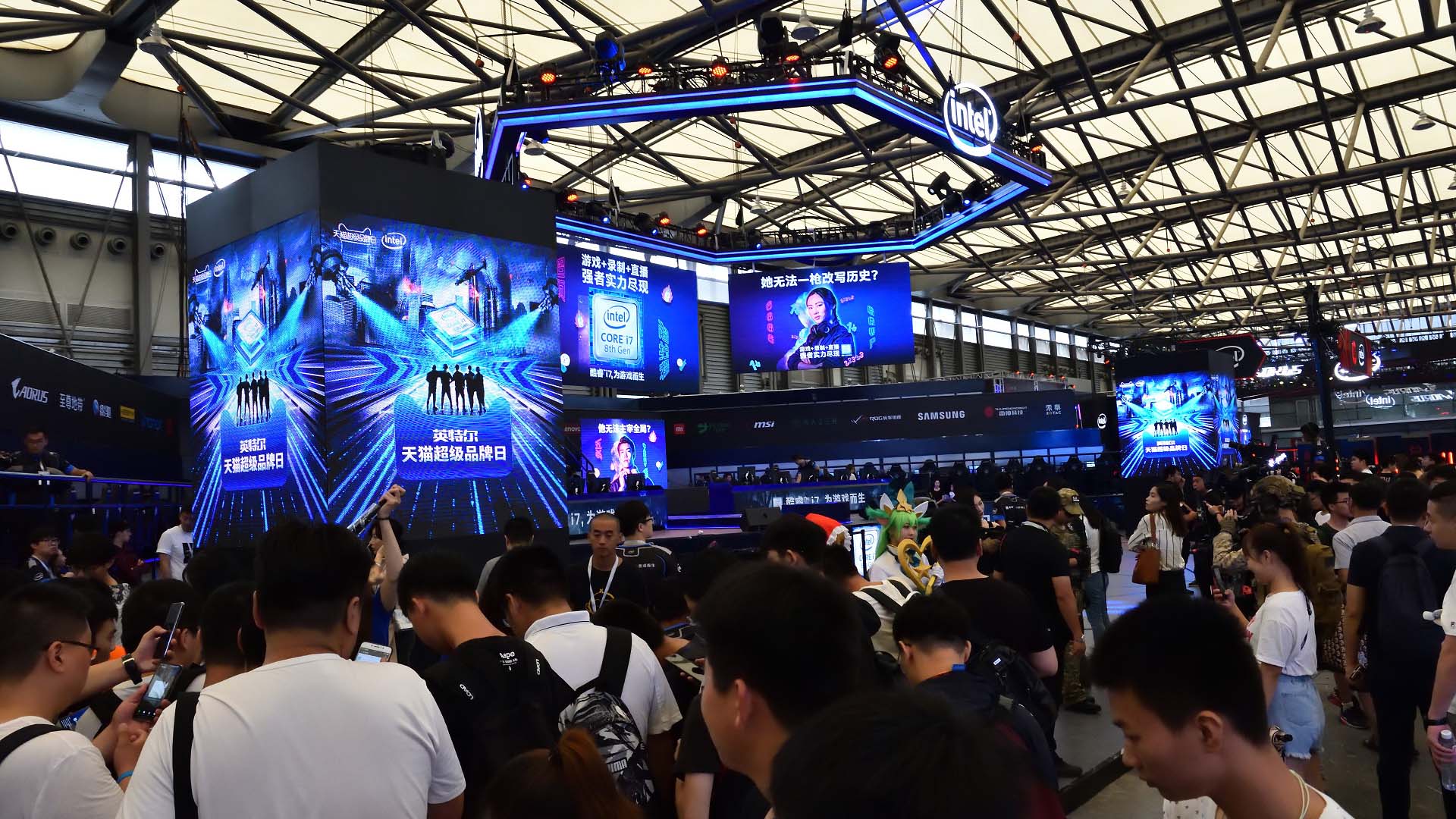

在經歷過因挖礦潮讓 AMD Radeon 與 NVIDIA GeForce 顯示卡價格狂漲之後,一般相信 PC 市場會迎來一個較平靜的氣氛,但意外總是不經意出現。就在挖礦潮結束的期間,Intel 14nm 製程產能出現短缺,傳出 Z390 晶片將被迫取消以及 22nm 製程的 H310C 晶片組推出等消息。

就在這些消息後,Intel 14nm 製程的處理器開始出現短缺以及漲價的現象。

雖然這種種現象並不影響 Intel 將在 10 月推出 Z390 晶片組與 9 代 Core 處理器的腳步,但市場對於供貨並不樂觀。

而在美國時間 9 月 28 日,Intel 代理 CEO 兼 CFO Bob Swan 針對公司近期產能供應問題發出一封名為「Supply Update」的公開信,類似的公開信在過去是相當少見的情況。

公開信中提到,數據量持續增加導致處理、儲存、分析到數據共享的需求有著驚人的需求。就 Intel 來說,數據中心的業務在 6 月成長 25%,雲端運算業務在 2018 前 6 個月增長 43%,至於 PC 方面的業務更是讓人驚訝;就 Gartner 的數據來說,PC 產業在第二季度的出貨量是近 6 年首次成長,而 Intel 則預期 2018 年會是 2011 年以來首次出現溫和成長的狀況。

這種種情況,對於 Intel 的產能造成了壓力。雖然公開信中沒有提到缺貨之類的字眼,但從產能造成壓力這樣的文字應用,間接可以確認目前 Intel 的 14nm 製程確實無法滿足出貨需求。

對於產能無法滿足市場需求,Bob Swan 在信中確認 Intel 將會增加額外費用(10 億美元)在 Oregon、Arizona、Ireland 以及 Israel 等 14nm 製程的生產基地(特別是 Core 與 Xeon 系列處理器部分),用以提升生產效率以及產能,滿足客戶需求。此外,信中也確定 10nm 製程已經取得一定進展,並預計在 2019 年開始進入量產階段。

Intel 14nm 製程缺貨,除了是既有的生意模式需求有所增長外,另一方面是 Apple 新一代 iPhone 使用的 Intel XMM Modem 需求高於 Intel 預期導致。

就眼下來說,Intel 的 14nm 製程要在 2018 年前滿足市場需求是不太可能發生的,2019 年的 10nm 製程確定量產後,也許能減緩部分市場對於 14nm 製程的需求,但一般相信這可能要到 2019 第三季後才會發生。

To our customers and partners,

The first half of this year showed remarkable growth for our industry. I want to take a moment to recap where we’ve been, offer our sincere thanks and acknowledge the work underway to support you with performance-leading Intel products to help you innovate.

First, the situation … The continued explosion of data and the need to process, store, analyze and share it is driving industry innovation and incredible demand for compute performance in the cloud, the network and the enterprise. In fact, our data-centric businesses grew 25 percent through June, and cloud revenue grew a whopping 43 percent in the first six months. The performance of our PC-centric business has been even more surprising. Together as an industry, our products are convincing buyers it’s time to upgrade to a new PC. For example, second-quarter PC shipments grew globally for the first time in six years, according to Gartner. We now expect modest growth in the PC total addressable market (TAM) this year for the first time since 2011, driven by strong demand for gaming as well as commercial systems – a segment where you and your customers trust and count on Intel.

We are thrilled that in an increasingly competitive market, you keep choosing Intel. Thank you.

Now for the challenge… The surprising return to PC TAM growth has put pressure on our factory network. We’re prioritizing the production of Intel® Xeon® and Intel® Core™ processors so that collectively we can serve the high-performance segments of the market. That said, supply is undoubtedly tight, particularly at the entry-level of the PC market. We continue to believe we will have at least the supply to meet the full-year revenue outlook we announced in July, which was $4.5 billion higher than our January expectations.

To address this challenge, we’re taking the following actions:

We are investing a record $15 billion in capital expenditures in 2018, up approximately $1 billion from the beginning of the year. We’re putting that $1 billion into our 14nm manufacturing sites in Oregon, Arizona, Ireland and Israel. This capital along with other efficiencies is increasing our supply to respond to your increased demand.

We’re making progress with 10nm. Yields are improving and we continue to expect volume production in 2019.

We are taking a customer-first approach. We’re working with your teams to align demand with available supply. You can expect us to stay close, listen, partner and keep you informed.

The actions we are taking have put us on a path of continuous improvement. At the end of the day, we want to help you make great products and deliver strong business results. Many of you have been longtime Intel customers and partners, and you have seen us at our best when we are solving problems.Sincerely,

Bob Swan

Intel Corporation CFO and Interim CEO